401k 2025 Contribution Limits Over 50. Of note, the 2025 pretax limit that applies to elective deferrals to irc section 401 (k), 403 (b) and 457 (b) plans increased from $22,500 to $23,000. The 401(k) contribution limit for 2025 is $23,500, up from $23,000 in 2025.

Employees can contribute up to $23,500 to their 401(k) plan for 2025 vs. The combined limit for employee and employer contributions is $69,000.

2025 IRS 401k IRA Contribution Limits Darrow Wealth Management, The overall 401 (k) limits for.

What Is The 401k 2025 Limit For Over 50 Barrie Leonelle, Of note, the 2025 pretax limit that applies to elective deferrals to irc section 401 (k), 403 (b) and 457 (b) plans increased from $22,500 to $23,000.

401k Contribution Limits And Limits (Annual Guide), This dollar amount is the same as in 2025.

2025 Max 401k Contribution Limits Debbie Lyndel, The 401 (k) contribution limit for 2025 is $23,500.

401 K Contribution Limits 2025 Over 50 Cinda Delinda, That means a total of $30,500 can be contributed.

Resources To Help You Manage Your 401k Independent 401k Advisors, The 401 (k) contribution limit for 2025 is $23,500.

401k Catch Up 2025 Contribution Limit Irs Taryn Francyne, That means a total of $30,500 can be contributed.

Hsa Contribution Limits For 2025 And 2025 Image to u, If you and your employer are both contributing to your 401 (k), the total contributions to the account can't exceed $69,000 in 2025.

401(k) Contribution Limits in 2025 Meld Financial, If you and your employer are both contributing to your 401 (k), the total contributions to the account can't exceed $69,000 in 2025.

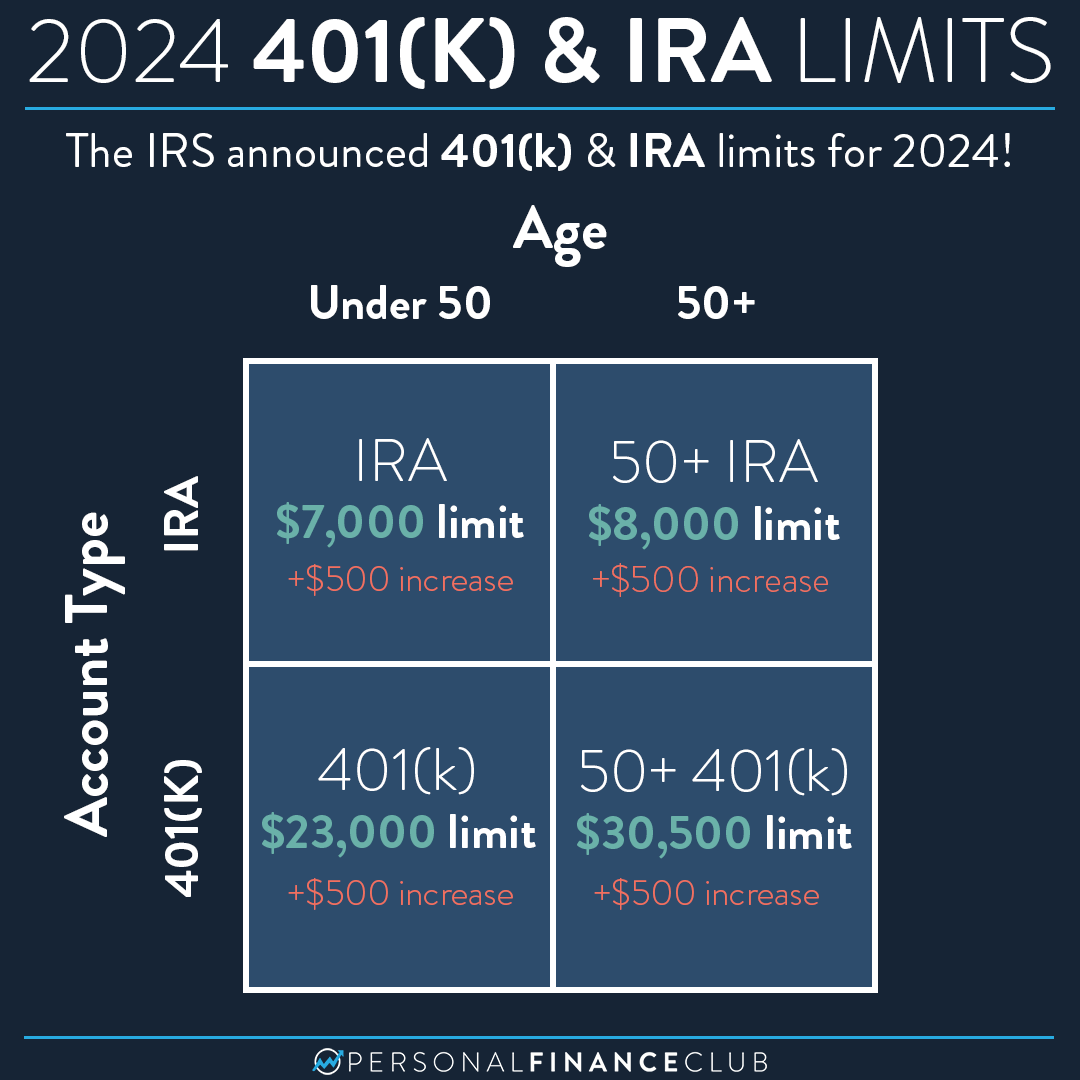

2025 401(k) and IRA contribution limits announced! Personal Finance Club, (for participants aged 50 or.